Montana Income Tax Rates 2025

Montana Income Tax Rates 2025. Welcome to the 2025 income tax calculator for montana which allows you to calculate income tax due, the effective tax rate and the. The montana department of revenue (dor) dec.

Tax rates chargeable income (€) from to rate subtract single rates. 1, 2025, the individual income tax rate was to be imposed at 4.7% on the first.

Welcome To The 2025 Income Tax Calculator For Montana Which Allows You To Calculate Income Tax Due, The Effective Tax Rate And The.

If you live or work in montana, you may need to file and pay individual income tax.

The Tables Below Show Income Tax Rates For Tax Year 2025.

121, enacted in march 2023, simplified the individual income tax system in montana and, effective january 1, 2025, reduced the number of tax brackets from seven to two.

Here, You Will Find A Comprehensive List Of Income Tax Calculators, Each Tailored To A Specific Year.

Images References :

Source: zigzagsandincense.blogspot.com

Source: zigzagsandincense.blogspot.com

montana sales tax rate 2020 Say It One More Microblog Portrait Gallery, Beginning january 1, 2025, the highest marginal tax rate will decrease from 6.75% to 5.9% and tax rates will now be based on the filing status the taxpayer uses on the federal income tax return (form 1040). Here, you will find a comprehensive list of income tax calculators, each tailored to a specific year.

Source: printableformsfree.com

Source: printableformsfree.com

Montana State Tax Form 2023 Printable Forms Free Online, Delivering on his promise to help montanans keep more of what they earn and make montana more competitive, gov. Major changes are coming to montana’s income tax system beginning in tax year 2025, including changes to filing statuses, tax brackets, and the calculation of montana taxable income.

Source: www.mountainstatespolicy.org

Source: www.mountainstatespolicy.org

tax rates going down in Montana, 1, 2025, the individual income tax rate was to be imposed at 4.7% on the first. Calculate your annual salary after tax using the online montana tax calculator, updated with the 2025 income tax rates in montana.

Source: www.lamansiondelasideas.com

Source: www.lamansiondelasideas.com

Montana Tax Rebate money in your bank account, Like the federal income tax, the montana state income tax is progressive, meaning the rate of taxation increases as taxable income increases. 1, 2025, the individual income tax rate was to be imposed at 4.7% on the first.

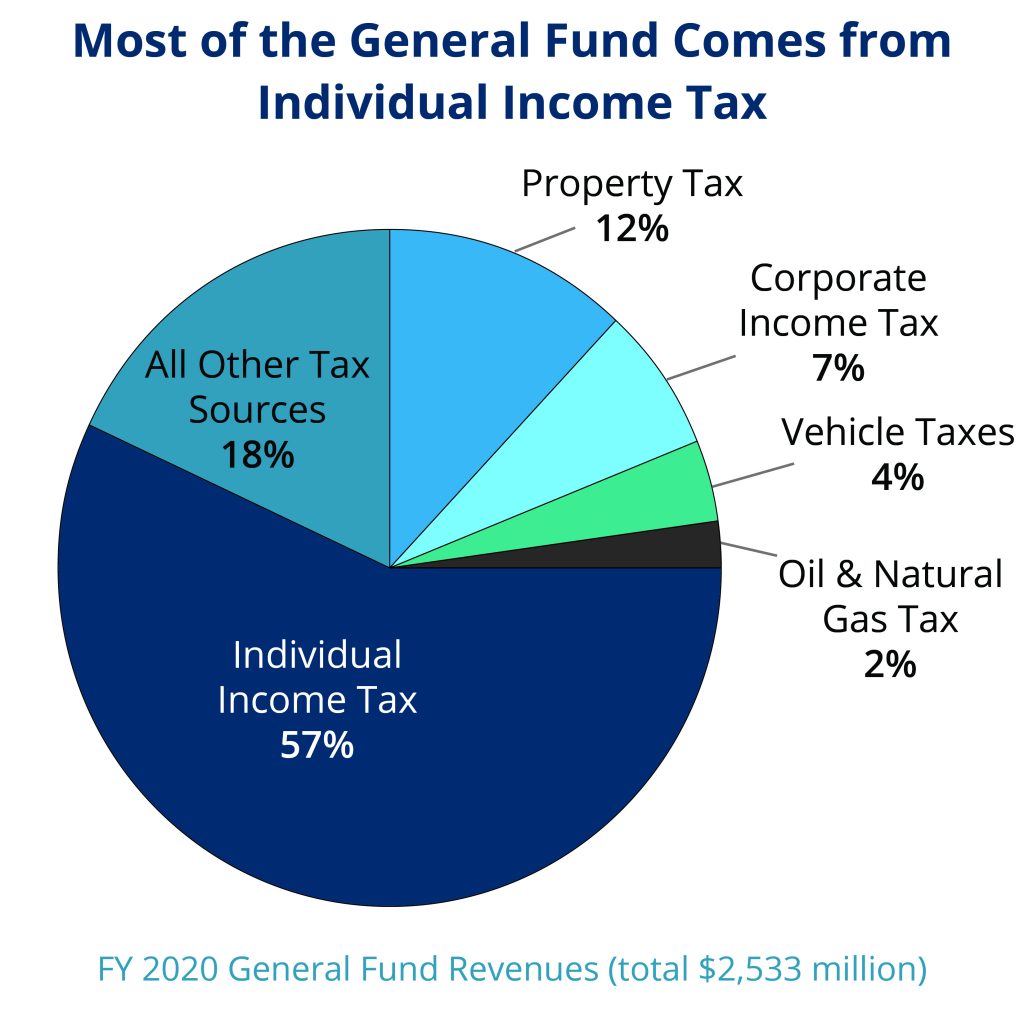

Source: montanabudget.org

Source: montanabudget.org

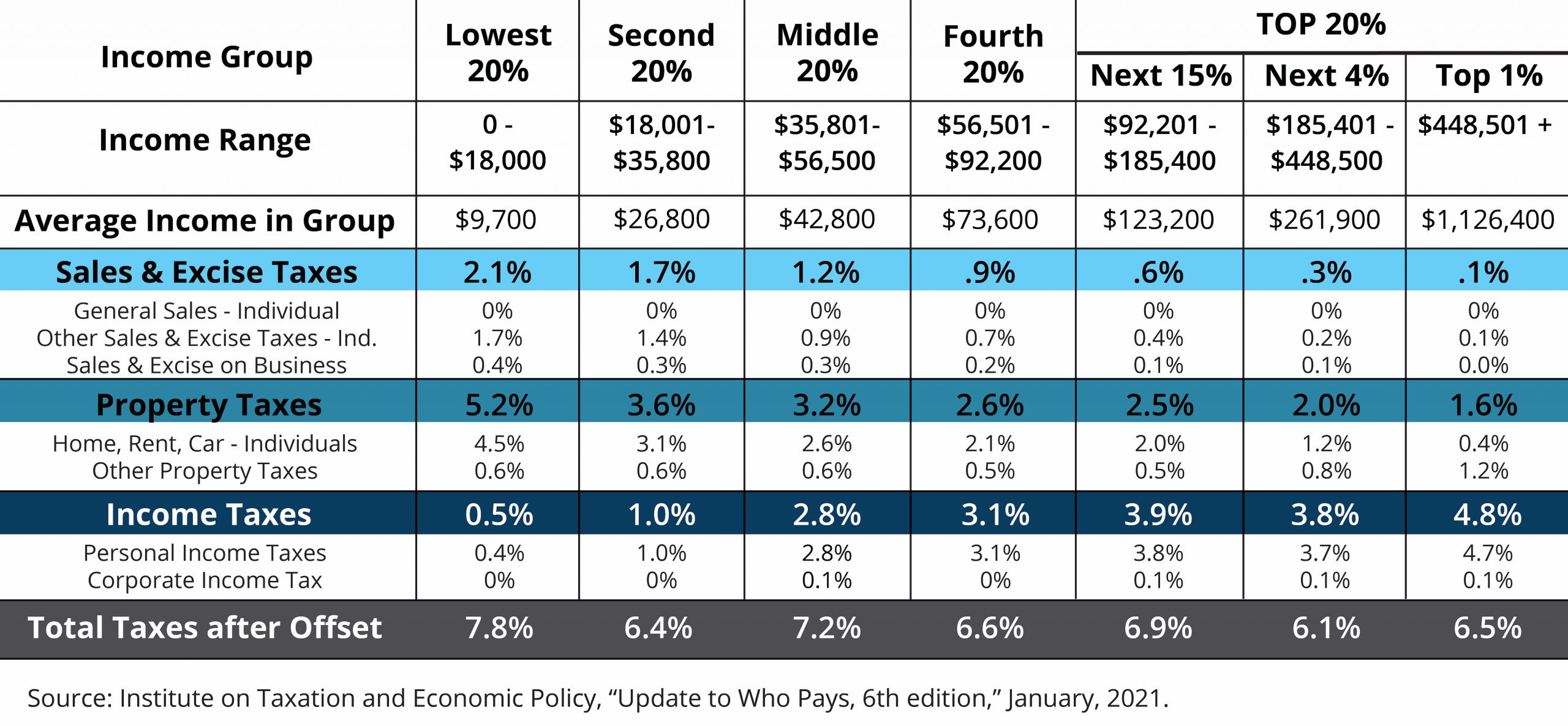

Policy Basics Who Pays Taxes in Montana Montana Budget & Policy Center, The tables below show income tax rates for tax year 2025. * in 2021, montana passed senate bill 399 which made several changes to the state’s tax code effective in 2025.

Source: www.taxuni.com

Source: www.taxuni.com

Montana Tax Calculator 2023 2025, Calculate your income tax, social security. Senate bill 399 will align the montana tax system more closely to.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, But there will be only two tax. Beginning january 1, 2025, the highest marginal tax rate will decrease from 6.75% to 5.9% and tax rates will now be based on the filing status the taxpayer uses on the federal income tax return (form 1040).

Source: montanabudget.org

Source: montanabudget.org

Policy Basics Individual Taxes in Montana Montana Budget, Here, you will find a comprehensive list of income tax calculators, each tailored to a specific year. The change to the method for calculating montana wage withholding will closely resemble the federal method.

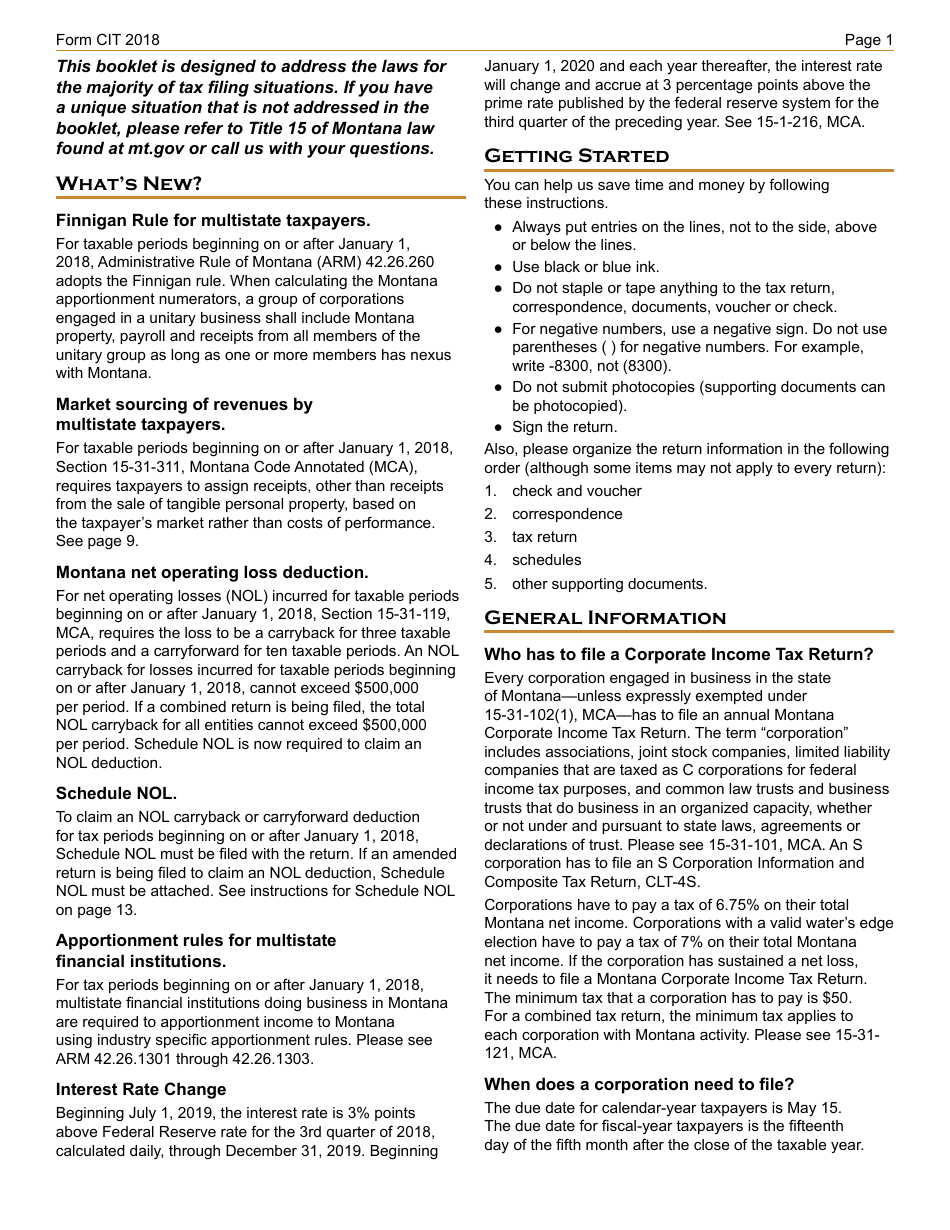

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for Form CIT Montana Corporate Tax Return, Back in 2021, the montana legislature approved a major overhaul to the state income tax structure, with the most significant adjustments set to take effect at the. Most residents use the state's standard deductions and credits to minimize their taxes.

Here are the federal tax brackets for 2023 vs. 2022, Use our income tax calculator to estimate how much tax you might pay on your taxable income. Calculate your annual salary after tax using the online montana tax calculator, updated with the 2025 income tax rates in montana.

Senate Bill 399 Will Align The Montana Tax System More Closely To.

The table above reflects income tax rates for 2023.

Montana State Income Tax Rates Are Between 1% And 6.75%.

Calculate your income tax, social security.