W4 Tax Tables 2024

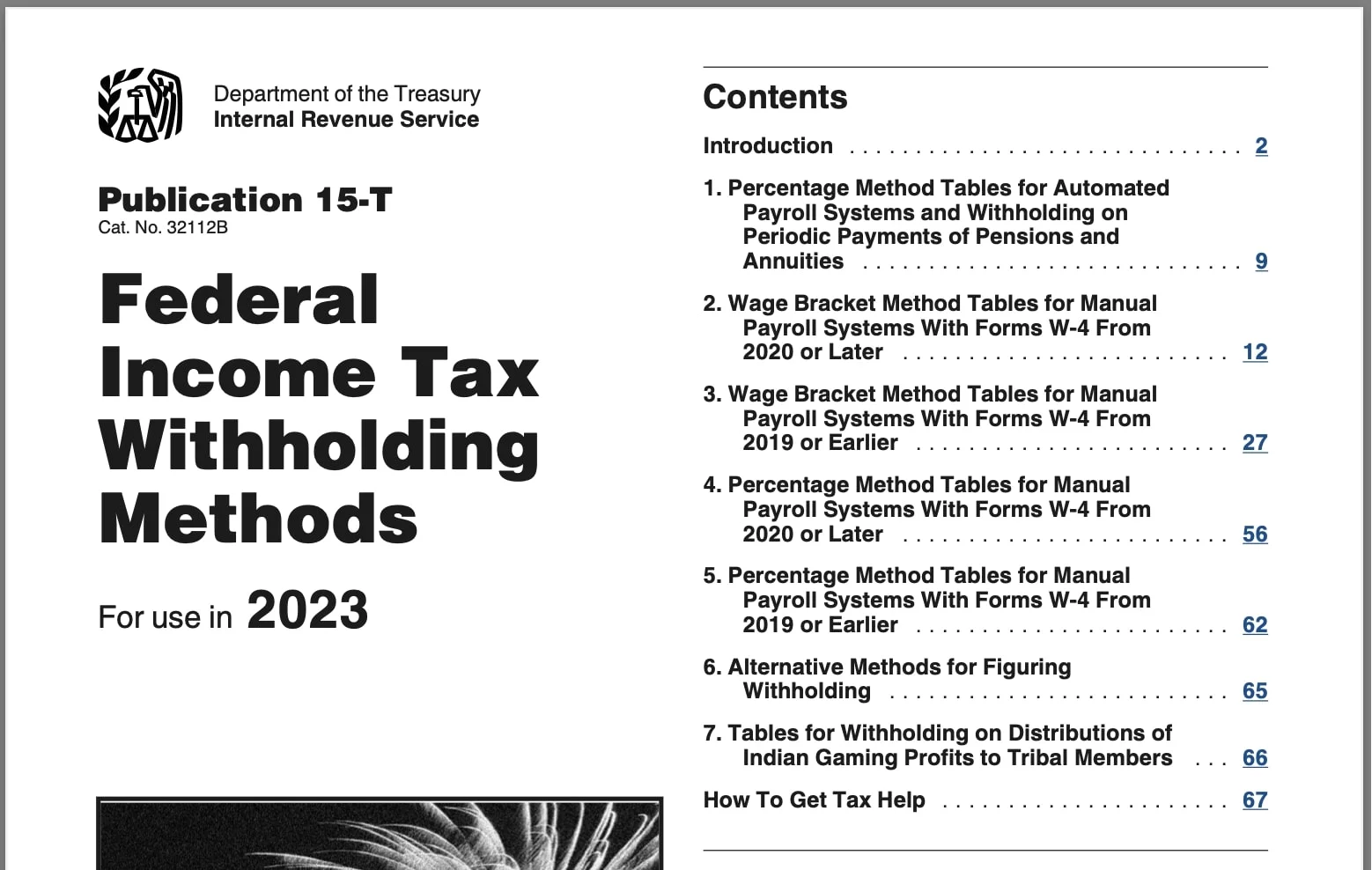

W4 Tax Tables 2024. Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. There are two methods for calculating federal income tax withholding—percentage and wage bracket methods.

Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The department updates withholding formulas and tables.

The Social Security Wage Base Limit Is $168,600.

This publication contains information regarding withholding tax filing requirements based on the tax law as of january 1, 2024.

For 2024, The Social Security Tax Rate Is 6.2% (Amount Withheld) Each For The Employer And Employee (12.4% Total).

It includes applicable withholding tax tables, basic.

The Department Updates Withholding Formulas And Tables.

Images References :

Source: atonce.com

Source: atonce.com

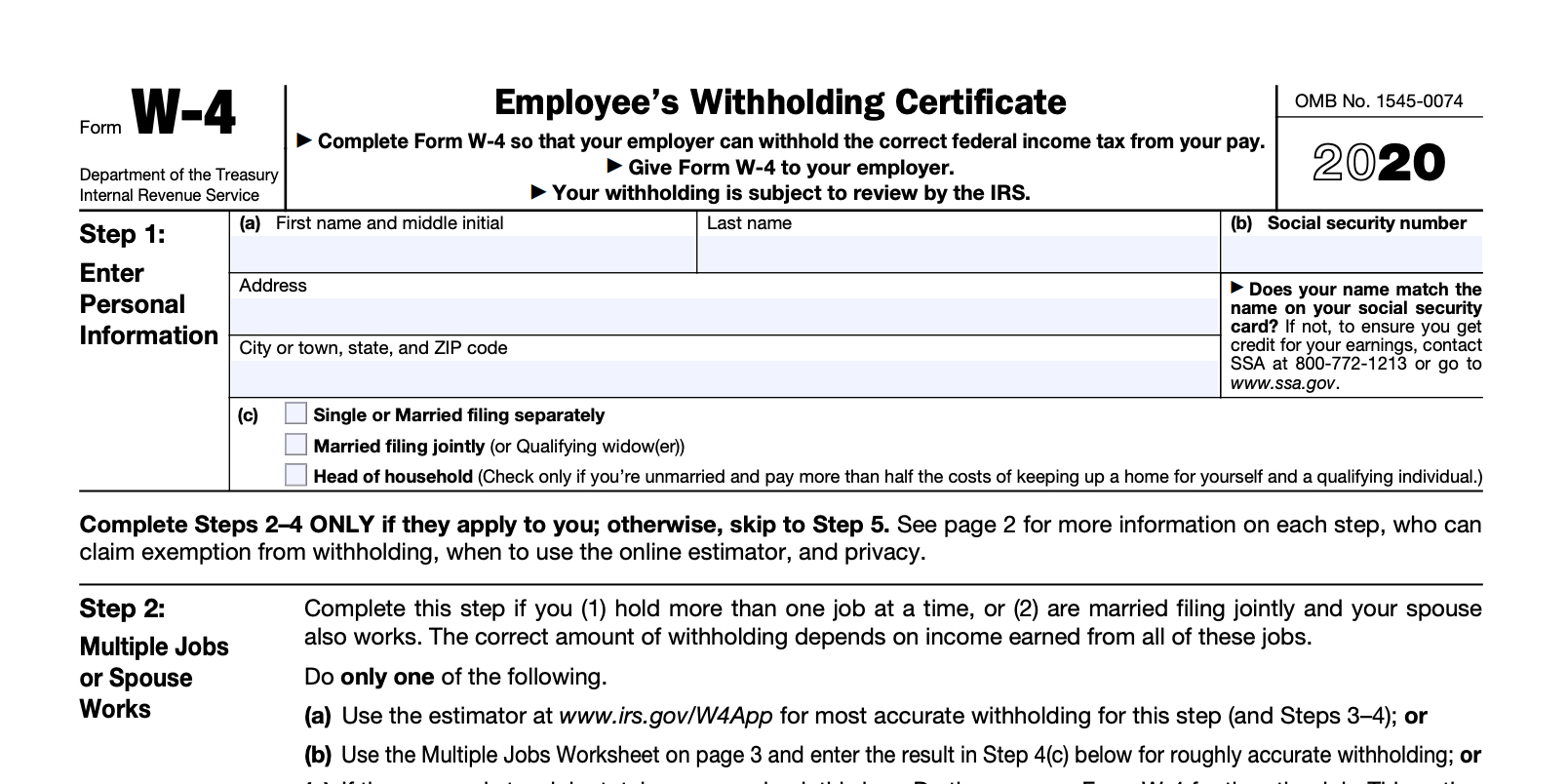

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to. The tax withholding tables include income tables similar to the.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, See current federal tax brackets and rates based on your income and filing status. If you have one of the changes in the following bullet list and you won't have enough tax withheld for the remainder of 2024 to cover your income tax liability for 2024, you are.

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, Here are the irs withholding tax tables for 2024 for employers that use an automated payroll system. The social security wage base limit is $168,600.

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Annual Tax Table 2024 Lily Shelbi, The amounts in the tax tables for use with the multiple jobs worksheet have been updated for 2024. The department updates withholding formulas and tables.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: projectopenletter.com

Source: projectopenletter.com

2022 Tax Tables Married Filing Jointly Printable Form, Templates and, Michigan pension and retirement payments withholding. The amounts in the tax tables for use with the multiple jobs worksheet have been updated for 2024.

Source: kayqdarelle.pages.dev

Source: kayqdarelle.pages.dev

2024 Tax Brackets And How They Work Ericka Stephi, Form used to apply for a refund of the amount of tax withheld on the. Page last reviewed or updated:

Source: brokeasshome.com

Source: brokeasshome.com

W4 Tax Deduction Table, 2024 michigan income tax withholding guide: See current federal tax brackets and rates based on your income and filing status.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, 2024 income tax withholding tables. The social security wage base limit is $168,600.

Source: isabelitawcary.pages.dev

Source: isabelitawcary.pages.dev

W4 Form 2024 Irs Daffy Drucill, There are two methods for calculating federal income tax withholding—percentage and wage bracket methods. Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to.

Source: www.zrivo.com

Source: www.zrivo.com

W4 Form 2023 2024, Page last reviewed or updated: It includes applicable withholding tax tables, basic.

2024 Michigan Income Tax Withholding Guide:

2024 michigan income tax withholding tables:

Michigan Pension And Retirement Payments Withholding.

For 2024, the social security tax rate is 6.2% (amount withheld) each for the employer and employee (12.4% total).